http://www.bimarket.cn/Report/ReportInfo.aspx?Id=25127

Abstract

Cathode materials for lithium-ion battery can be chiefly classified by material structure into three categories:

First, the laminated materials such as LiCoO2, LiNiO2, LiMO2 (M=NiCo, NiCoMn);

Second, the materials of the spinel solid, like LiMn2O4;

Third, intercalates with olivine structure such as LixMPO4 (M=Fe, Mn, Co)

The first-generation cathode material refers to lithium cobaltate (LCO) whose voltage platform is 4.2V in general and which gets mainly used in consumer electronics. As the compacted density and energy density of LCO is on the edge of extremes, there emerges the latest technology trend -- LCO mixed high-voltage compacted density NCM ternary material, to produce high voltage battery cells.

The second-generation cathode materials consist of LMO, NCM/NCA, LFP, etc., of which NCM ternary material embraces bright prospects and has been widely used in fields such as notebook computer, tablet computer, mobile phone, electric tool, electric bicycle and electric vehicle. With lower costs compared with traditional LCO, NCM tends to replace LCO in the mobile terminals field. Now in China, 85 percent of NCM ternary materials find application in mobile terminal field and among which at least 80 percent adopts cost-efficient NCM523 cathode material.

The third-generation cathode materials refer to the laminated lithium-rich manganese series materials, lithium nickel manganese oxide spinel high-voltage materials, etc. and they have not yet been massively commercialized and are the hotspot in the research of cathode materials worldwide.

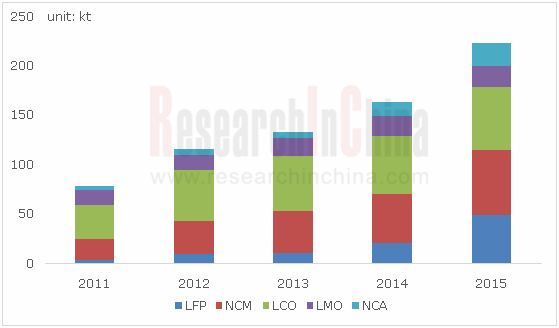

The global shipment of cathode materials reached 223,400 tons in 2015, surging by 35.89% from the previous year. Thanks to brisk demand for electric vehicles, LFP and NCA show rapid growth among which NCA gets primarily used for Panasonic 18650 cylindrical batteries (to be supplied to Tesla EVs) and substantial growth of LFP benefits mainly from China’s EV demand, particularly robust demand for electric buses as well as application in energy storage field.

Currently, the world’s ternary material manufacturers are principally from Japan, S.Korea and China, holding a combined market share of 50% worldwide. Japanese companies are expert at technologies and have rich experience; S.Korean peers have sprung up and tend to outpace Japanese ones in both technology and quality; while Chinese counterparts that accessed into the industry late are mainly involved in the medium and low-end markets with gross margin of less than 10% and serious homogeneity of products.

At present, concentration of ternary material supply is improving in China, with four leaders including Hunan Shanshan Advanced Material, Xiamen Tungsten, Ningbo Jinhe New Materials, and Shenzhen Zhenhua New Materials together holding close to 50% market shares. In future, the market will be seized by the listed companies with strength in technology and capital.

In 2015, the shipment of NCM ternary material was up to 30,500 tons with a year-on-year surge of 45.2% in China, and the output value reported RMB3.27 billion, up 35% from a year earlier and manly spurred by growth in electric vehicles’ demand for power batteries and substitution for LCO.

In addition to NCM, there is also little shipment of NCA ternary material in China, mainly contributed by Tianjin Lishen’s 18650 NCA ternary lithium batteries for JAC’s Iev5. Since NCA has strong chemical activity and poses exceedingly high requirements on battery thermal management system, electric vehicles in China have rare use of NCA. In 2015, the shipment of NCA ternary material approximated 2,000 tons in China.

With improvements in compacted densification, energy density, voltage, etc., ternary materials’ application in the digital domain (like tablet PC and notebook computer) sees a rising proportion. What’s more, the demand for ternary materials from electric tool market also keeps growing.

In the EV sector, the newly launched EVs in China in 2015 consisting of BAIC BJEV EV200, Chery eQ, JAC Iev4, ZOTYE Cloud 100, etc all apply ternary power batteries. According to the posed requirements on new energy vehicle innovation projects by the Ministry of Industry and Information Technology of the People’s Republic of China (MIIT), in 2015, the energy density of lithium battery monomer should be not less than 180Wh/kg, the energy density of battery module is not less than 150Wh/kg, and the cycle life lasts for more than 2,000 times or ten years. Considering factors like energy density, cycle life and costs, LFP is hard to meet the new-generation lithium batteries for new energy vehicle, and the ternary cathode materials will become the mainstream technology route of cathode materials for lithium power batteries.

It is highly probable for ternary materials to replace LFP and become the mainstream cathode materials for power batteries. Only a few cathode material enterprises are capable of producing high nickel NCM622 in China. It is expected that in 2017 the penetration of ternary materials in China will be up to 20%, and till 2020 abide by 1kwh needy of 1.3kg of ternary materials, China’s demand for NCM will amount to 155,000 tons and the demand for NCA ternary material will reach 8,000 tons, from which a hug rigid gap of ternary cathode materials can be seen.

As concerns technology trends, the novel lithium-rich laminated ternary materials are possible to be utilized as the cathode material for future high-energy-density lithium-ion battery due to exceedingly high specific capacity and excellent cycling competence. Currently, first discharge of 0.1C (C stands for capacity) such material is higher than 250mAh/g and capacity retention ratio is above 90% after the cycling of thirty times, presenting remarkable electrochemical properties. The research and development of lithium-rich ternary materials is of great significance to the industrialization of power battery.

Global and China Ternary Cathode Materials (NCA/NCM) and Battery Industry Report, 2016-2020 by ResearchInChina highlights the followings:

Supply and demand of ternary materials in China and the world, particularly the shares of applications in such fields as new energy vehicle and consumer electronics;

Competitive landscape in China and beyond, covering domestic and overseas companies’ market share, capacity planning, market pattern, etc.;

Technology routes and development trends of ternary materials in China and the world;

Analysis on upstream and downstream market segments of ternary materials, consisting of cobalt metal, lithium carbonate, ternary precursor, ternary lithium battery, etc.;

Key application growth points of ternary cathode materials, and analysis of electric vehicle industry in China and the world;

Operation, technologies, development plans and production & sales dynamics of six manufacturers of ternary cathode materials from countries like Japan, S.Korea, Belgium and Germany;

Operation, technologies, development plans and production & sales dynamics of fourteen Chinese ternary cathode material manufacturers;

Operation, technologies, development plans and production & sales dynamics of seven producers of ternary lithium battery from nations such as Japan, S.Korea and Europe;

Operation, technologies, development plans and production & sales dynamics of nine Chinese ternary lithium battery manufacturers.

Global Shipment of Cathode Materials(LFP/NCM/LCO/LMO/NCA), 2011-2015

Source: ResearchInChina

Table of Contents

1 Overview of Ternary Cathode Materials

1.1 Definition

1.2 Classification

1.2.1 Nickel-cobalt-manganese Ternary Cathode Materials (NCM)

1.2.2 Nickel-cobalt-aluminum Ternary Cathode Materials (NCA)

1.3 Production Methods

2 Global Ternary Cathode Material Industry

2.1 Overview of Global Cathode Material Market

2.2 Global Ternary Cathode Material Market

2.2.1 Shipment

2.2.2 Price

2.2.3 Market Share

2.2.4 Corporate Competitive Landscape

2.2.5 Technology Trend

2.3 Ternary Cathode Material Market in Major Countries or Regions

2.3.1 Japan

2.3.2 South Korea

3 China Ternary Cathode Material Industry

3.1 Overview of Chinese cathode material Market

3.2 Chinese Ternary Cathode Material Market

3.2.1 Shipment

3.2.2 Price

3.2.3 Market Size

3.2.4 Corporate Competitive Landscape

3.3 Policy

3.4 Development Trend

4 Ternary Cathode Material Industry Chain

4.1 Upstream

4.1.1 Cobalt

4.1.2 Lithium Carbonate

4.1.3 Ternary Precursor

4.2 Downstream

4.2.1 Lithium Battery of Consumer Electronics (3C)

4.2.2 Power Lithium Battery

4.2.3 Ternary Cathode Material Lithium Battery

5 Global and Chinese Electric Vehicle Market

5.1 Global Electric Vehicle Market

5.1.1 Overall Market

5.1.2 The United States

5.1.3 Europe

5.1.4 Japan

5.2 Chinese Electric Vehicle Market

5.2.1 Overall Market

5.2.2 Passenger Car

5.2.3 Commercial Vehicle

6 Foreign Ternary Cathode Materials Companies

6.1 Belgium Umicore

6.1.1 Profile

6.1.2 Financial Operation

6.1.3 Production Base

6.1.4 Layout in China

6.1.5 Ternary Cathode Material Business

6.2 Japan Nichia

6.2.1 Profile

6.2.2 Development Course

6.2.3 Financial Operation

6.2.4 Output

6.3 South Korea L&F

6.3.1 Profile

6.3.2 Financial Operation

6.3.3 Output

6.4 Japan Toda Kogyo

6.4.1 Profile

6.4.2 Financial Operation

6.4.3 Ternary Cathode Material Business

6.5 Germany BASF

6.5.1 Profile

6.5.2 Layout in China and Worldwide

6.5.3 Financial Operation

6.5.4 Ternary Cathode Material Business

6.5.5 Technology Roadmap

6.6 Japan Sumitomo Metal Mine

6.6.1 Profile

6.6.2 Financial Operation

6.6.3 Global Layout

7 Chinese Ternary Cathode Materials Enterprises

7.1 Hunan Shanshan Advanced MaterialCo., Ltd.

7.1.1 Profile

7.1.2 Financial Operation

7.1.3 Output and Sales Volume

7.1.4 Products

7.1.5 Core Competence

7.1.6 Performance Prediction

7.2 Beijing Easpring Material Technology Co., Ltd.

7.2.1 Profile

7.2.2 Development Course

7.2.3 Financial Operation

7.2.4 Capacity

7.2.5 Customers

7.2.6 Ternary Cathode Material Business

7.2.7 Performance Prediction

7.3 Xiamen Tungsten Co., Ltd.

7.3.1 Profile

7.3.2 Financial Operation

7.3.3 Capacity

7.3.4 Core Competence

7.3.5 Performance Prediction

7.4 Shenzhen Green Eco-manufacture Hi-tech

7.4.1 Profile

7.4.2 Development Course

7.4.3 Financial Operation

7.4.4 Capacity

7.4.5 Ternary Cathode Material Business

7.4.6 Core Competence

7.4.7 Performance Prediction

7.5 Fujian Zhonghe Co., Ltd.

7.5.1 Profile

7.5.2 Development Course

7.5.3 Financial Operation

7.5.4 Capacity

7.5.5 Core Competence

7.5.6 Performance Prediction

7.6 Kingray New Materials Science & Technology Co., Ltd.

7.6.1 Profile

7.6.2 Financial Operation

7.6.3 Capacity

7.6.4 Performance Prediction

7.7 Ningbo Jinhe New Materials Co., Ltd.

7.7.1 Profile

7.7.2 Financial Operation

7.7.3 Capacity

7.7.4 Core Competence

7.8 Shenzhen Tianjiao Technology Co., Ltd.

7.8.1 Profile

7.8.2 Financial Operation

7.8.3 Capacity

7.8.4 Performance Prediction

7.9 Xinxiang Tianli Energy Material Co., Ltd.

7.9.1 Profile

7.9.2 Financial Operation

7.9.3 Capacity

7.9.4 Performance Prediction

7.10 Henan Kelong New Energy Co., Ltd.

7.10.1 Profile

7.10.2 Financial Operation

7.10.3 Capacity

7.10.4 Performance Prediction

7.11 Hunan Changyuan Lico Co., Ltd.

7.11.1 Profile

7.11.2 Financial Operation

7.11.3 Capacity

7.12 Pulead Technology Industry Co., Ltd.

7.12.1 Profile

7.12.2 Ternary Cathode Materials

7.13 Hunan Reshine New Material Co., Ltd.

7.13.1 Profile

7.13.2 Ternary Cathode Material Business

7.14 Jiangxi Ganfeng Lithium Co., Ltd.

8 Major Global Ternary Lithium Battery Manufacturers

8.1 Panasonic

8.1.1 Profile

8.1.2 Battery Technology

8.1.3 Business Development and Prospect

8.1.4 Layout in China

8.1.5 Customers

8.1.6 Output Capacity

8.2AESC

8.2.1 Profile

8.2.2 Battery Technology

8.2.3 Business Development and Prospect

8.2.4 Layout in China

8.2.5 Capacity and Output

8.3LEJ

8.3.1 Profile

8.3.2 Battery Technology

8.3.3 Business Development and Prospect

8.3.4 Customers

8.3.5 Capacity and Output

8.4 LGC

8.4.1 Profile

8.4.2 Battery Technology

8.4.3 Business Development and Prospect

8.4.4 Customers

8.4.5 Layout in China

8.4.6 Capacity and Output

8.5 Samsung SDI

8.5.1 Profile

8.5.2 Battery Technology

8.5.3 Business Development and Prospect

8.5.4 Customers

8.5.5 Layout in China

8.5.6 Capacity and Output

8.6 SKI

8.6.1 Profile

8.6.2 Battery Technology

8.6.3 Business Development and Prospect

8.6.4 Layout in China

8.6.5 Capacity and Output

8.7 Li-Tec&Accumotive

8.7.1 Profile

8.7.2 Battery Technology

8.7.3 Business Development and Prospect

8.7.4 Customers

9 Major Chinese Ternary Lithium Battery Manufacturers

9.1 Tianjin Lishen

9.1.1 Profile

9.1.2 Battery Technology

9.1.3 Business Development and Prospect

9.1.4 Customers

9.1.5 Capacity and Output

9.2 ATL

9.2.1 Profile

9.2.2 Battery Technology

9.2.3 Business Development and Prospect

9.2.4 Industry Chain

9.2.5 Investment and Capacity

9.2.6 Production and Marketing

9.3 China Bak Battery

9.3.1 Profile

9.3.2 Battery Technology

9.3.3 Business Development and Prospect

9.3.4 Customers

9.3.5 Capacity and Output

9.4 Wanxiang EV

9.4.1 Profile

9.4.2 Battery Technology

9.4.3 Business Development and Prospect

9.4.4 Customers

9.5 Sinopoly Battery

9.5.1 Profile

9.5.2 Battery Technology

9.5.3 Business Development and Prospect

9.5.4 Customers

9.5.5 Output and Capacity

9.6 CITIC GUOAN Mengguli

9.6.1 Profile

9.6.2 Battery Technology

9.6.3 Business Development and Prospect

9.7 China Aviation Lithium Battery

9.7.1 Profile

9.7.2 Battery Technology

9.7.3 R & D

9.7.4 Business Development and Prospect

9.7.5 Customers

9.7.6 Output and Capacity

Selected Charts

Structure Diagram of Laminated LiNi1/3Co1/3Mn1/3O2

Performance Comparison of Ternary Cathode Materials

Performance Parameters of NCM Ternary Cathode Material

Metal Demand from NCM Ternary Cathode Material

Merits and Demerits of Ternary Synergy Effect

Comparison of Sundry Models of NCM Ternary Cathode Material

Cost Analysis of Sundry Models of NCM Ternary Cathode Material

Comparison of NCM Performance with Different Composition Ratios

Performance Parameters of NCA Ternary Cathode Material

Metal Demand from NCA Ternary Cathode Material

Comparison of NCM, NCA and LFP

NCM Lithium Manufacturing Methods and Features

Process Flow of NCM Coprecipitation Method

Global Shipment of Cathode Materials (LFP/NCM/LCO/LMO/NCA), 2011-2015

Consumption Structure of Lithium Battery Cathode Materials Worldwide, 2015

Performance Comparison of Ternary Cathode Materials and Other Cathode Materials

Development Orientation of Li-ion Battery Cathode Materials

Michael Porter’s Five Forces Model of Global Cathode Materials Industry

Market Share of Cathode Material Manufacturers Worldwide, 2014

Global Shipment of Ternary Cathode Materials (NCA/NCM), 2011-2015

Global Shipment of Ternary Cathode Materials, 2009-2020

Price Trend of Ternary Cathode Materials Worldwide, 2010-2020

Shares (%) of Cathode Materials (LFP, LCO, LMO, NCM) (for Electric Vehicle), 2020

Shares (%) of Cathode Materials (LFP, LCO, LMO, NCM) (for 3C Consumer Electronics), 2020

Market Share of Ternary Cathode Material Manufacturers Worldwide, 2014

Application of Patents for Ternary Cathode Materials Worldwide

Technological Tendencies of Ternary Cathode Material Technologies, 2015-2030

Auto Models Supported by Ternary Cathode Materials in Japan

Shipment of NCM Ternary Cathode Materials in Japan, 2012-2015

Sales of NCM Ternary Cathode Materials in Japan, 2012-2015

Auto Models Supported by Ternary Cathode Materials in South Korea

Development Roadmap of Ternary Cathode Materials in South Korea

Shipment of Cathode Materials (NCM/LCO/LFP/LMO) in China, 2011-2015

Output of Cathode Materials (NCM/LCO/LFP/LMO) in China, 2014Q1-2015Q2

Products, Revenue and Capacity of Key Cathode Material Manufacturers in China, 2014

Capacities and Clients of Major Domestic Cathode Material Manufacturers in China, 2015

Prices of Cathode Materials in China, 2010-2016

Ternary Cathode Material (NCM) Shipment in China, 2011-2015

Ternary Cathode Materials (NCM/NCA) Shipment in China, 2015-2020

Ternary Cathode Material Capacities of Leading Manufacturers in China

Capacities (GWh) of Key Chinese Ternary Lithium Battery Manufacturers, 2015-2017

Prices of NCM 523 and LFP in China, 2011-2015

Market Size of Ternary Cathode Materials in China, 2013-2020

Market Shares of Key Chinese Ternary Cathode Material Manufacturers, 2015

National Policy’s Requirements on Lithium Battery

Status Quo of Research on Lithium-rich Ternary Cathode Materials in China

Development Trends of Ternary Cathode Materials in China

Percentages of Cobalt Applications

Amount of Cobalt Consumed by Different Ternary Cathode Materials

Distribution of Cobalt Resource Reserves Worldwide

Distribution of Cobalt Resource Reserves in China

Cobalt Supply and Demand in China, 2011-2015

Cobalt Demand Structure Worldwide

Cobalt Demand Structure in China

Lithium Carbonate Supply in the World, 2012-2020

Lithium Carbonate Demand in the World, 2012-2020

Global Demand for Lithium Carbonate (by Sector), 2012-2020

Output of Lithium Carbonate in China, 2009-2020

Proportion of China’s Lithium Carbonate Output in Global Total, 2012-2020

Supply-demand Gap of Lithium Carbonate in China, 2009-2020

Downstream Consumption Structure of Lithium Carbonate Worldwide, 2013

Downstream Consumption Structure of Lithium Carbonate Worldwide, 2015

World’s Leading EV Makers’ Selection of Cathode Materials

Ternary Precursor Capacities of Leading Manufacturers in China

National Policy on Ternary Precursor Export Rebates, 2015

Ternary Precursor Preparation Methods

Comparison of Mainstream Ternary Cathode Material Precursor Preparation Technologies

Lithium Battery Demand Structure Worldwide, 2012-2020

Consumption of Lithium Battery Worldwide (by Products), 2015

Global Demand from Consumer Electronics for Lithium Battery and Growth Rates, 2013-2020

Sales Volume of Mobile Phones and Demand for Lithium Battery Worldwide, 2012-2020

Sales Volume of Tablet Computers and Demand for Lithium Battery Worldwide, 2012-2020

Competitive Landscape of Global Tablet Computer Market, 2013-2015

Sales Volume of Notebook PCs and Demand for Lithium Battery Worldwide, 2012-2020

Sales Volume of Electronic Cigarettes and Shares (%) Worldwide, 2012-2020

Electric Vehicles’ Demand for Lithium Power Battery Worldwide (by Type), 2011-2020

Battery Capacity (Single Vehicle) of Electric Passenger Cars Worldwide, 2011-2020

Demand for Lithium Power Battery in China (by Type), 2011-2020

Cost Structure of 100Ah Ternary Cathode Material Li-ion Battery

Trend for Energy Density Development of Ternary Cathode Materials, 2015-2019

China’s Output of Power Batteries in Different Systems, 2014-2018

Installation of Ternary Batteries in Battery Electric Passenger Cars in China, Nov 2015

Auto Models Supported by Ternary Cathode Material Lithium Battery Overseas

Ternary Lithium Battery Projects which are Newly Built or Put into Production in China

Ternary Cathode Material Battery Market Size, 2020

Auto Models Supported by Newly Launched Ternary Battery in Chinese Market, 2015

Sales Volume of Electric Passenger Cars Worldwide (by Major Countries), 2013-2014

Sales Volume of World’s Top 20 Electric Passenger Car Brands, 2013-2014

Sales Volume of World’s Top 20 Electric Passenger Car Brands, 2015H1

Sales Volume of Electric Passenger Cars (EV&PHEV) Worldwide, 2011-2020

Sales Volume of Electric Vehicles in the United States (by Auto Model), 2013-2015H1

Sales Volume of Electric Vehicles in Europe (by Auto Model), 2013-2015H1

Sales Volume of Electric Vehicles in Japan (by Auto Model), 2013-2015H1

Output and Sales Volume of Electric Vehicles in China, 2010-2015

Output of New Energy Vehicles (EV&PHEV) in China, Jan-Dec.2015

Sales Volume of Electric Vehicles (EV&PHEV) in China, 2011-2020

Sales Volume of Electric Passenger Cars (EV&PHEV) in China, 2011-2020

Sales Volume of New Energy Passenger Cars (EV &PHEV) in China, Jan-Dec.2015

Output of New Energy Commercial Vehicles in China, Jan-Dec.2015

Electric Vehicle Promotion Program in China, 2014-2015

Output of New Energy Buses in China, Jan-Dec.2015

Output of Battery Electric Trucks in China, Jan-Dec.2015

Sales Volume of Electric Commercial Vehicles (EV & PHEV) in China, 2011-2020

Umicore’s Financials, 2011-2015H2

Umicore’s Cathode Material Production Bases Worldwide

Umicore’s Operations in China

Umicore’s Offices and Business Distribution in China

Umicore’s Ternary Cathode Material (NCM) R&D Route

Development Course of Nichia

Nichia’s Revenue, 2009-2014

Nichia’s Output of Cathode Materials, 2012 & 2013

L&F’s Total Revenue, 2006-2014

L&F’s Output of Cathode Materials, 2012 & 2013

Toda Kogyo’s Financials, 2012-2015

Structure of Toda Kogyo’s Lithium Battery Cathode Material Products

Performance of Toda Kogyo’s Ternary Cathode Material Products

BASF’s Global Integrated Network and Production Bases

BASF’s Layout and Distribution of Production Bases in China

BASF’s Financials, 2011-2015

BASF’s Key Ternary Cathode Material Products

BASF’s Cathode Material Research and Production Bases Worldwide

BASF’s Research Priorities and Methods of Ternary Cathode Materials

Comparison of BASF’s Ni-MH Batteries and Lead-acid Batteries

SMM’s Financials, 2012-2015

SMM’s Revenue Structure, FY2015

SMM’s Material Business Layout Worldwide

Organization Structure of Ningbo Shanshan in New Energy Field

Operating Results of Hunan Shanshan Advanced Material, 2009-2014

Cathode Material Product Lines of Hunan Shanshan Advanced Material

Physical and Chemical Indexes of Major Products of Hunan Shanshan Advanced Material

Performance Forecast of Ningbo Shanshan, 2012-2017

Joint-stock and Shareholding Companies of Beijing Easpring Material Technology

Development Course of Beijing Easpring Material Technology, 1992-2015

Operating Results of Beijing Easpring Material Technology, 2009-2015

Revenue Structure of Beijing Easpring Material Technology (by Products), 2015H2

Revenue Structure of Beijing Easpring Material Technology (by Regions), 2015H2

Major Global Clients of Beijing Easpring Material Technology for Small-sized Cathode Material Products

Sales Volume of Ternary Cathode Materials of Beijing Easpring Material Technology, 2011-2016

Performance Forecast of Beijing Easpring Material Technology, 2015-2017

Operating Results of Xiamen Tungsten, 2009-2015

Revenue Structure of Xiamen Tungsten (by Products), 2015H2

Capacity Planning of Xiamen Tungsten, 2016

Performance Forecast of Xiamen Tungsten, 2016-2017

Development Route of Shenzhen Green Eco-manufacture Hi-tech, 2001-2016

Operating Results of Shenzhen Green Eco-manufacture Hi-tech, 2009-2015H3

Revenue Structure of Shenzhen Green Eco-manufacture Hi-tech (by Products), 2015H2

Current Capacity of Shenzhen Green Eco-manufacture Hi-tech

Ternary Cathode Material Business Revenue of Shenzhen Green Eco-manufacture Hi-tech, 2012-2014

Performance Forecast of Shenzhen Green Eco-manufacture Hi-tech, 2016-2017

Lithium Battery Industry Chain of Fujian Zhonghe

Development History of Fujian Zhonghe’s Lithium Battery Business

Operating Results of Fujian Zhonghe, 2009-2015H3

Revenue Structure of Fujian Zhonghe (by Products), 2015H2

Lithium Battery Material Product Capacity and Planning of Fujian Zhonghe

Performance Forecast of Fujian Zhonghe, 2016-2017

Operating Results of Kingray New Materials Science & Technology, 2009-2015H3

Revenue Structure of Kingray New Materials Science & Technology (by Products), 2015H2

Capacity Details of Kingray New Materials Science & Technology

Performance Forecast of Kingray New Materials Science & Technology, 2016-2017

Capacity Details of Ningbo Jinhe New Materials Co., Ltd.

Operating Results of Shenzhen Tianjiao Technology, 2013-2015H2

Output of Ternary Cathode Materials of Shenzhen Tianjiao Technology, 2016-2017

Performance Forecast of Shenzhen Tianjiao Technology, 2015-2017

Operating Results of Xinxiang Tianli Energy Material, 2013-2015H1

Revenue Structure of Xinxiang Tianli Energy Material (by Products), 2014

Output of Xinxiang Tianli Energy Material, 2015-2017

Performance Forecast of Xinxiang Tianli Energy Material, 2015-2017

Revenue Structure of Henan Kelong New Energy, 2013

Capacity Details of Ternary Cathode Materials of Henan Kelong New Energy

Performance Forecast (Battery Material Business) of Henan Kelong New Energy, 2015-2017

Product Features of PU50A

Product Features of PU50B

Operating Results of Panasonic, FY2008/09-FY2013/14

R&D Expenditure of Panasonic, FY2008/09-FY2013/14

Revenue Structure of Panasonic (by Segment), 2012-2014

Operating Income Structure of Panasonic (by Segment), 2012-2014

Revenue Structure of Panasonic (by Region), 2014

Technical Parameters of Panasonic’s NCA 18650 Cell for Tesla

Development Plan of Panasonic’s Automotive Batteries, 2013-2019

Development Plan of Panasonic’s Automotive Division, 2013-2019

Development Plans of Panasonic’s Business Divisions, 2013-2019

Electric Vehicles Supported by Panasonic’s Lithium Power Batteries

Tesla EV Delivery, 2010-2016

Panasonic’s Shipment of Power and Energy Storage Batteries, 2011-2015

Equity Structure of AESC, 2014

Cost Structure of AESC’s BEV Cell Materials

Battery Module Structure of AESC’s Lithium Power Battery

Specifications and Serial & Parallel Connection Modes of AESC’s High-capacity Power Batteries

Performance Parameters of AESC’s High-capacity Power Batteries

Specifications and Serial & Parallel Connection Modes of AESC’s High-power Batteries

Performance Parameters of AESC’s High-power Batteries

AESC’s Power Battery System Solutions

Electric Vehicles Supported by AESC’s Lithium Power Batteries

AESC’s Shipment of Power and Energy Storage Batteries, 2011-2015

Equity Structure of LEJ, 2014

Specifications of LEJ’s Lithium Power Batteries

Electric Vehicles Supported by LEJ’s Lithium Power Batteries

LEJ’s Shipment of Power and Energy Storage Batteries, 2011-2015

Equity Structure of LGC, 2014

Operating Results of LGC, 2007-2015H1

Revenue Breakdown of LGC by Regions, 2014

Cost Structure of LGC’s PHEV Cell Materials

LGC Road Map for HEV LIB Technology

LGC Road Map for PHEV LIB Technology

LGC Road Map for EV LIB Technology

LGC’s Lithium Business Development and Prospects

Operating Results of LGCPI (LG Chem Power Inc), 2010-2014

Operating Results of HL Green Power, 2010-2014

Operating Results of LGC’s Battery Business, 2013Q1-2015Q2

Electric Vehicles Supported by LGC’s Lithium Power Batteries

Administrative Organs of LGC in China

LGC’s Production and Marketing Network in China

LGC’s Shipment of Power and Energy Storage Batteries, 2012-2015

Equity Structure of SDI, 2014

Operating Results of SDI, 2008-2015H1

Revenue Breakdown of SDI by Regions, 2014

SDIRoad Map for xEV LIB Technology

Technical Performance of SDI’s Lithium Power Battery Cell

Operating Results of SDI, 2007-2015H1

SDI’s Battery Shipment and ASP, 2007-2014

SDI’s Revenue from Power and Energy Storage Batteries, 2013Q1-2014Q4

Electric Vehicles Supported by SDI’s Lithium Power Batteries

SDI’s Shipment of Power and Energy Storage Batteries, 2012-2015

Main Subsidiaries under SKI

Electric Vehicles Supported by SKI’s Lithium Power Batteries

Equity Structure of BESK (SKI’s Joint Venture in China)

Basic Information of BESK (SKI’s Joint Venture in China)

Technical Parameters of BESK’s Lithium Power Batteries

Specifications of Li-Tec’s High-capacity Power Battery

Performance Parameters of Li-Tec’s High-capacity Power Battery

Li-tec’s Power Battery Plant in Landkreis Kamenz, Germany

Equity Structure of Tianjin Lishen

Operating Results of Tianjin Lishen, 2011-2015H1

Cell Technology Roadmap of Tianjin Lishen

Battery Pack (Module) Technology Roadmap of Tianjin Lishen

Performance Parameters of Spiral Cell of Tianjin Lishen

Performance Parameters of Laminated Cell of Tianjin Lishen

Performance Parameters of Polymer Cell of Tianjin Lishen

Technical Parameters of Battery Cell of Tianjin Lishen

Power Battery Clients of Tianjin Lishen

Performance Parameters of Power Battery Pack (Module) of Tianjin Lishen

Lithium Battery Capacity of Tianjin Lishen, 2000-2015

Power Battery Investment Plan of Tianjin Lishen, 2012-2015

Operating Results of ATL, 2008-2014

Basic Information of ATL-QH

Clients Supported by ATL’s Power and Small-sized Batteries

ATL’s Power Battery Suppliers

ATL’s Battery Output and Utilization, 2012-2014

ATL’s Capacity Layout of Power and Small-sized Batteries (by the end of 2014)

ATL’s Power and Energy Storage Battery Business Revenue and Prices, 2012-2014

ATL’s Revenue from Small-sized Lithium Battery, 2008-2014

ATL’s Shipment of Small-sized Lithium Batteries, 2008-2014

Operating Results of China BAK Battery, 2008-2015H1

Revenue Structure of China BAK Battery by Regions, 2009-2014

R&D Investment of China BAK Battery, 2010-2015H1

Technical Parameters of China BAK Battery’s Power Battery Cell

Basic Information of BAK International (Tianjin)

Basic Information of Dalian BAK Power Battery

Lithium Battery Revenue of China BAK Battery, 2009-2015H1

Power Battery Investment Plan of China BAK Battery, 2013-2015

Revenue and Gross Margin of Sinopoly Battery, 2011-2015H1

Net Income of Sinopoly Battery, 2011-2015H1

Technical Parameters of Sinopoly Battery’s Power Cell

Operating Results of CITIC GUOAN Mengguli, 2009-2015H1

Technical Parameters of Cathode Materials of CITIC GUOAN Mengguli

Technical Parameters of Power Battery Module of CITIC GUOAN Mengguli

Equity Structure of China Aviation Lithium Battery, 2014

Operating Results of China Aviation Lithium Battery, 2010-2014

BEV BMS of China Aviation Lithium Battery

Battery Product Certifications of China Aviation Lithium Battery

Global Marketing Network of China Aviation Lithium Battery

Major Customers of China Aviation Lithium Battery

http://www.bimarket.cn/Report/ReportInfo.aspx?Id=25127