报告链接:http://www.bimarket.cn/Report/ReportInfo.aspx?Id=22980

Description

Authors: Dr Peter Harrop, Chairman, IDTechEx and Edward Benjamin, eCycleElectric Consultants

Written by IDTechEx and the world's leading expert on LEVs, with the longest track record, this LEV report looks closely at global trends in their technology, manufacture and market drivers such as legislation. The analysis is balanced, with negative factors exposed such as several Chinese cities banning or severely restricting LEVs. The LEV industry is growing fast, with greatest strength in China today, but also clearly emerging fast in the rest of the world. Up until the last couple of years, ebike sales were concentrated in China, Japan, and the EU. In the last few years, nearly every nation has bought ebikes from China, and in some cases, the volumes are now significant. Sales will reach 130 million yearly before 2025, making it one of the world's largest industries. The report encompasses over 70 brands, and gives forecasts of sales numbers, unit prices and total market value for 2013-2023. Market drivers are balanced against many negative factors that are discussed in the report, and detail on standards and legislation is given.

LEVs are one of the largest and fastest growing electric vehicle markets. A Light Electric Vehicle (LEV) is a land vehicle propelled by an electric motor that uses an energy storage device such as a battery or fuel cell, has two or three wheels, and typically weighs less than 100kg. Most LEVs are and will remain ebikes. These are Power on Demand bikes controlled with a throttle. A significant percentage of ebikes sold are scooters in that they have the driver's feet rest on a platform - they are not straddled by the driver.

Today, the LEV industry is dominated by large bicycle companies, due to their access to distribution. We explain why, in the future, these companies will face major competition from, and may be pushed aside by car, motorcycle, and car parts companies. Supply chains for motors, batteries, chassis parts, and nearly every LEV component exist in Asia, primarily in China, Taiwan, Japan, and newly emerging South Korea. We reveal where the highest profits will be obtained in future and the opportunities in components as these change with lithium-ion batteries of several generations and supercapacitors being increasingly employed, for example. The more demanding future technical requirements of users and standards are investigated.

Micro-EVs and allied vehicles

Other vehicles closely allied to LEVS but not technically LEVs include more than electric motorcycles and mobility vehicles for the disabled covered in this report every year. This year we also include the newly successful car-like vehicles called Micro EVs that are variously classified as motorcycles, quad bikes and, in Europe, the special category quadricycles. This year Micro EV become a separate category in IDTechEx forecasts because they are now a substantial rapidly growing business. For example, the Philippines has ordered 100,000 e-trike taxis in 2013.

Adjoining sectors are also discussed such as heavy electric motorcycles and the bigger sector of mobility vehicles for the disabled, where ten year forecasts are presented. New crossover vehicles between LEVs and these sectors are presented.

Market Forecasts from IDTechEx

This report includes forecasts for LEV numbers and market value from 2013 to 2023.

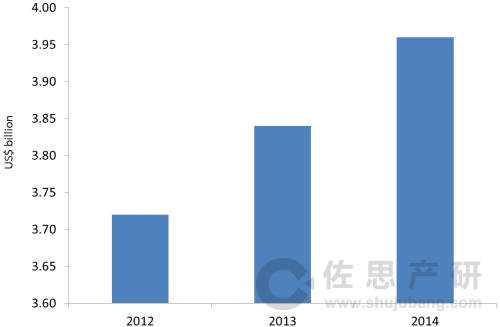

LEV total global market value*

*For the full forecast data please purchase this report

Source: IDTechEx

Table of Contents

1.EXECUTIVE SUMMARY AND CONCLUSIONS

1.1.Forecast for numbers of LEVs sold globally to 2025

1.2.Pricing

1.3.Market value forecast

1.4.Reasons for growth

1.4.1.Competition and profitability

1.4.2.Opportunities

1.4.3.Typical requirement

1.5.The USA Electric Bicycle market by Ed Benjamin, eCycleElectric

2.CAR-LIKE VEHICLES NOT HOMOLOGATED AS CARS: MICROEV, QUADRICYCLE, E TRIKE, NEV, GOLF CAR

2.1.Many names, common factors

2.2.Car-like vehicles that evade restrictions, taxes and other costs

2.3.Philippines: big new commitments to e trikes

2.3.1.Terra Motors, Japan

2.4.Listing of manufacturers beyond golf cars

2.5.Toyota i-ROAD e-trike is a scooter/ MicroEV crossover

2.6.MicroEV racing cars

2.7.Golf cars

2.7.1.What is included

2.7.2.Market drivers

2.7.3.Listing of manufacturers

2.7.4.Market forecasts 2012-2023

3.INTRODUCTION TO LIGHT ELECTRIC VEHICLES

3.1.Definition of a light electric vehicle

3.2.How good does it have to be?

3.3.What retail price?

3.4.What is an electric bicycle?

3.4.1.e-bikes in Europe

3.4.2.Pedelec

3.4.3.Power on Demand bikes and other categories

3.4.4.Electric vehicles for disabled and others

3.4.5.Power restriction

3.4.6.Notable regulations

3.5.Universal Technical Terms for Ebikes

3.6.Choices of LEV

3.6.1.Rocket drag bike USA

3.6.2.Moveo foldable scooter Hungary

3.6.3.Motorised Skateboard Yuneec China

3.6.4.Hubless Scooter E'lution EVO Australia

3.7.The Industry of LEVs

3.7.1.Taiwan and China

3.7.2.Outside Taiwan and China

3.7.3.Too much cost cutting

3.8.Tricycles to reduce accidents and help policing

3.8.1.Twikke Europe

4.MOBILITY FOR THE DISABLED - THE SECTOR WITH THE MOST COMPELLING AND ENDURING NEED

4.1.The demographic time-bomb

4.1.1.Ageing population and the dependent elderly

4.1.2.Laws make mobility easier

4.2.Types of mobility vehicle

4.2.1.Growth by new market segments

4.2.2.Interchina Industry Group China

4.2.3.Solar powered power chair in 2013

4.3.Market drivers

4.3.1.Geographical distribution

4.3.2.Needs creating new segments

4.3.3.What is driving regional differences?

4.3.4.Zhejiang R&P Industry China

4.3.5.Pride Mobility, USA

4.3.6.Toyota Japan

4.4.Listing of manufacturers

4.5.Market forecasts 2012-2022

4.5.1.Growth by creating new markets

5.LEV TECHNOLOGIES

5.1.Battery Technology - as currently used in LEVs, on a pack level

5.1.1.SVRLA strengths and weaknesses

5.1.2.Battery packagers

5.1.3.Battery Packs from China

5.1.4.Power management and user interface

5.1.5.Electric motor controller

5.1.6.Motor Controls:

5.1.7.Accessory features:

5.1.8.Chinese Coin Charger

5.1.9.Energy harvesting

5.1.10.User Interface

5.1.11.Real Time Data Logging and Reporting

5.1.12.Infrastructure challenges and Government incentives

5.2.Examples of battery suppliers to this sector

5.2.1.Advanced Battery Technologies (ABAT) China

5.2.2.Leyden Energy USA

5.2.3.PowerGenix USA

5.2.4.ReVolt Technologies Ltd Switzerland

5.2.5.Toshiba Japan

6.LEV STANDARDS AND COMPONENT INDUSTRIAL TRENDS

6.1.Standards Efforts

6.2.Component industry trends

6.3.LEV electric motor industry

6.4.Controller industry

6.5.Wiring harness and connectors

7.LEV MARKETS, MARKET DRIVERS AND FORECASTS

7.1.Markets by territory

7.1.1.China

7.1.2.Japan

7.1.3.India

7.1.4.Europe

7.1.5.USA

7.1.6.Worldwide

7.2.Markets by providers

7.3.Bicycle Brands with ebikes or expected to have ebikes soon:

7.3.1.USA

7.3.2.European Bike Brands

7.3.3.Netherlands brands:

7.4.Channels of distribution

7.5.Market forecasts and drivers

7.6.Drivers of market

7.6.1.Fuel price

7.6.2.Fuel availability

7.6.3.Efficiency

7.6.4.Cost of government subsidy

7.6.5.Traffic congestion

7.6.6.Parking congestion

7.6.7.Urbanization

7.6.8.Air pollution

7.6.9.Government regulation

7.6.10.Personal responsibility

7.6.11.Total cost of ownership

7.6.12.Aging populations

7.6.13.Living in apartments

7.6.14.Negative factors

7.6.15.Bans in Malaysia and elsewhere?

8.ELECTRIC SCOOTERS

8.1.Market dynamics

8.2.Dominated by East Asia for the next decade

8.2.1.Brazil

8.2.2.China

8.2.3.Europe

8.2.4.France

8.2.5.Germany

8.2.6.India

8.2.7.Japan

8.2.8.Taiwan

8.2.9.Korea

8.3.Retro scooters

8.4.Push scooters

8.5.Folding scooters and energy harvesting

APPENDIX 1: LISTINGS OF LEV BRANDS, OEMS, COMPONENT MAKERS

APPENDIX 2: ADDITIONAL REGULATORY SUPPORT

APPENDIX 3: IDTECHEX EV PUBLICATIONS AND CONSULTANCY

TABLES

1.1.LEV number, unit value in dollars ex-factory and total global market value 2012-2023

2.1.Listing of manufacturers beyond golf cars

2.2.MicroEV quadricycle forecasts 2012-2023

2.3.19 examples of golf EV manufacturers

2.4.Global sales of electric golf cars and motorised caddies in number thousands, ex-factory unit price in thousands of dollars and total value in billions of dollars 2012-2023, rounded

2.5.Geographical split of golf EV sales by value 2010, 2015 and 2020

4.1.Statistics relevant to the challenge to society caused by ageing population

4.2.Evolution of three families of powered vehicles for the disabled

4.3.Evolution of power chairs 1980 to 2010

4.4.Evolution of scooters for the disabled 1980 to 2010

4.5.The continental percentage split of markets for vehicles for the disabled by value in 2010

4.6.The percentage split of market for vehicles for the disabled by country within Europe

4.7.The numbers in thousands of scooters plus power chairs that were and will be sold in Europe 2005 to 2015

4.8.Features of mobility vehicles that may hold up the price by offering more in future

4.9.The percentage distribution of manufacture between Taiwan and Mainland China by value of vehicles for the disabled 2005, 2010 and 2015

4.10.Market for EVs for the disabled by geographical region, ex works pricing and percentage split in 2005, 2010 and 2020

4.11.82 examples of manufacturers of EVs for the disabled by country

4.12.Global sales of EVs used as mobility aids for the disabled by number, ex-factory unit price in thousands of dollars and total value in billions of dollars, 2012-2023, rounded

7.1.World e-bike sales (Units) estimated for 2007-2010

7.2.Chinese cities banning or restricting electric bikes.

8.1.e-scooter number and ex-factory price by region for 2013 compared to the total market for LEVs.

FIGURES

1.1.LEV number in thousands 2012-2023

1.2.LEV unit value in dollars ex-factory 2012-2023

1.3.LEV total global market value in dollar billions 2012-2023

2.1.Car-like vehicles not homologated as cars, in the context of two wheelers and Europe. Love them or hate them?

2.2.The Daimler Smart, left, is a mainstream car subject to tax, insurance, crash tests etc. whereas the G-Whiz from India, right, is registered as a quadricycle and was the best-selling pure electric car in the UK for ten years with

2.3.Renault Twizy quadricycle which is selling over ten thousand within two years from launch. The standard model has no windows

2.4.Chinese micro-EV cars in China. Most of them have three wheels

2.5.E-trikes

2.6.Terra Motors e-vehicles

2.7.Toyota i-ROAD e-trike

2.8.E-Rex microEV racing car

2.9.Tonaro golf and general purpose vehicle from China

2.10.Suzhou Eagle two and four seat golf cars from China

2.11.Yongkang Fourstar golf vehicles from China

2.12.Shadong Wuzheng golf cars from China

2.13.Jinhua Ryder golf car from China

3.1.Chinese Repair in the Street

3.2.Chinese Ebike Tire Repair

3.3.Escooter or Ebike?

3.4.Traditional Chinese Ebike

3.5.Optibike USA "The Ferrari of Electric Bikes"

3.6.Small French Folding Ebike

3.7.DK City db0 Ebike

3.8.Voltitude folding pedelec

3.9.Chinese domestic ebike left and Currie IZ ViaRapido ebike right

3.10.Electric motor scooters in China

3.11.Electric moped by Ultra Motor

3.12.Electric motorcycle by Vectrix

3.13.Electric mini scooters by Currie Technologies

3.14.Segway personal transporter

3.15.Toyota Winglet personal transporter

3.16.3 wheel LEV with windshield and cover

3.17.The folding Yike Bike from New Zealand

3.18.Ebike by Ultra Motor A2B

3.19.LEV Shop Window with ebike.

3.20.EU small folding ebike

3.21.Chinese ebike loaded down

3.22.Chinese ebike rider

3.23.Chinese ebike with two riders

3.24.Ebikes used at Chinese factories

3.25.China LEVs at stop light

3.26.Ebike Food Delivery for Papa John's in China

3.27.Ebike food delivery by A2B Ultra Motor

3.28.LEV four wheeler for seniors - a crossover from LEVs to mobility for the disabled

3.29.Shawn Lawless Rocket drag bike

3.30.Moveo foldable scooter Hungary

3.31.Yuneec motorised skateboard

3.32.E'lution hubless push scooter

3.33.IBD Bloomfield Bikes Ebike Display in CT USA

3.34.Electric tricycle

3.35.Examples of three wheel leisure and delivery vehicles promoted at EVS26 in California May 2012

3.36.TriBred electric Trikke patrol vehicle and general purpose version

4.1.Percentage of dependent elderly 1970 to 2040

4.2.New Pihsiang Shoprider pure electric mobility vehicle for the disabled

4.3.The Electric Car (INEC-KARO) for the disabled from Interchina Industry Group

4.4.Solar powered power chair vehicle for the mobility impaired

4.5.Zhejiang R&P Industry ES 413

4.6.Pride Jazzy - making new things possible

4.7.Toyota single seat enclosed vehicle for disabled mobility Nagoya October 2014

5.1.Battery pack interiors

5.2.Controller by Suzhou Bafang

5.3.Lead Acid Battery Charger by High Power

5.4.Solar parking lot for charging by Sanyo

5.5.User Interface by Gepida

5.6.User Interface by BionX

5.7.UI 1 Photo with phone Interface

5.8.Toshiba e-bike battery

6.1.SVRLA battery sizes by Long

6.2.Transparent battery box

6.3.Innovative Chinese motor

6.4.High speed brushless motor by Bafang

6.5.Typical connector

7.1.Example of China exports to the EU

7.2.Hero Electric of India Flash Ebike 1

7.3.Pedego

7.4.Electric vehicle energy consumption per passenger kilometer with full occupation.

8.1.Peugeot e-Vivacity

8.2.E-scooter promotion in India

8.3.Terra motors electric scooter with smartphone

8.4.Suzuki experimental scooter

8.5.Sanyo system

8.6.Kymco two wheel pure electric scooter

8.7.Leo scooter initially with lithium polymer battery

8.8.Retro scooters

8.9.The Kooper scooters

8.10.KPV scooter

报告链接:http://www.bimarket.cn/Report/ReportInfo.aspx?Id=22980