Global and China Tire Mold Industry Report, 2012-2015

-

Apr.2013

- Hard Copy

- USD

$1,900

-

- Pages:73

- Single User License

(PDF Unprintable)

- USD

$1,800

-

- Code:

LMX033

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$2,800

-

- Hard Copy + Single User License

- USD

$2,100

-

Since 2011, the global tire market, especially the Chinese tire market, has seen slow growth, which directly impacts the market demand for tire molds.

In 2012, China tire mold industry harvested the revenue of RMB3.01 billion or so, including RMB1.87 billion from automotive tire molds, only up 0.16% year on year.

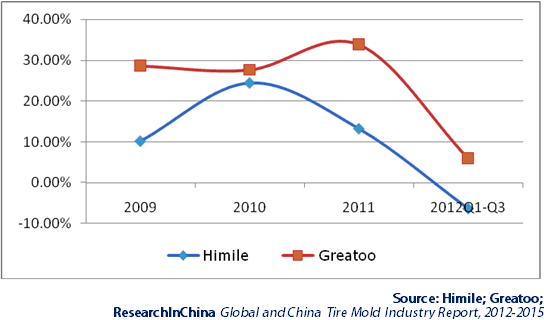

In terms of profitability, the performance of most Chinese tire mold manufacturers declined in 2012. During the first three quarters of 2012, Himile's revenue only increased by 0.37% year on year, and its net income fell by 6.28%. Meanwhile, the growth rate of Greatoo also slowed down, with the revenue being the same with that in the same period in 2011 and net income up by5.92%.

Net Income Growth Rate of Major Listed Tire Mold Companies in China, 2009-2012

Among other non-listed companies, the revenue of Shandong Dawang Jintai dropped by 21.77% year on year in 2012, and that of Yuantong witnessed a year-on-year decline of 12.26%.

Seen from new construction project, there were merely two major tire mold projects in 2012: the tire mold project co-invested with a total capital of RMB1.1 billion by Henan Yasheng and Jiaozuo Deke Mould; and the 300-set radial tire mold virtual manufacturing technology project of Shandong Dawang Jintai.

In the projects invested and built before 2012, Himile's “precise radial tire mold construction project” is delayed until the end of September 2013 instead of the planned December 2012, with the investment of RMB349 million. Greatoo's “large-sized engineering vehicle tire and special tire mold expansion project” is under construction; the project aims at the mold market of military SUV tires, aerospace tires, racing tires, snow tires, high-grade sedan tires, etc, with huge market potentials. With total investment of RMB197 million; the project is expected to be put into production in July 2013.

Although the current tire mold industry is sluggish, we expect that China's domestic demand for tire molds will grow at the average annual growth rate of around 7% with the moderate recovery of Chinese automobile market in the next 2-3 years.

The report highlights the followings:

Development, competition and future development trends of the global tire mold industry;

Major policies, operation, supply and demand, market competition and outlook of China tire mold industry;

Main products, operation and development planning of major producers worldwide;

Major products, capacity, operation, major customers, project planning and performance prediction of major Chinese manufacturers.

Preface

1. Overview of Tire Mold Industry

1.1 Definition

1.2 Classification

1.3 Upstream and Downstream

1.4 Production Process

1.5 Features

2. Development of Global Tire Mold Industry

2.1 Status Quo

2.2 Competition

2.3 Development Trend

3. Development of China Tire Mold Industry

3.1 Industry Policy

3.1.1 Policies over the Years

3.1.2 Expiration of Sino-US Special Protectionist Tariff on Tire Industry

3.1.3 Implementation of EU Tire Label Rule

3.2 Overview

3.2.1 Development Course

3.2.2 Operation

3.2.3 Existing Problems

3.3 Supply

3.3.1 Capacity

3.3.2 Profitability

3.4 Demand

3.4.1 Overall Demand

3.4.2 Demand for Radial Tire Mold

3.4.3 Export Demand

3.5 Competition

3.5.1 Regional Competition

3.5.2 Corporate Competition

3.6 Outlook

4. Global Key Enterprises

4.1 Quality Mold Inc.

4.2 A-Z Formen- und Maschinenbau GmbH

4.3 HERBERT Maschinenbau GmbH & Co. KG

4.3.1 Profile

4.3.2 Main Tire Mold Products

4.4 SAEHWA IMC

4.4.1 Profile

4.4.2 Development Course

4.4.3 Main Tire Mold Products

4.4.4 Operation

4.4.5 Development in China

4.4.6 Strategy

5. Chinese Key Enterprises

5.1 Himile Mechanical Science & Technology Co., Ltd

5.1.1 Profile

5.1.2 Development Course

5.1.3 Tire Mold Products

5.1.4 Operation

5.1.5 Revenue Structure

5.1.6 Gross Margin

5.1.7 Clients

5.1.8 R & D and Projects

5.1.9 Forecast and Outlook

5.2 Guangdong Greatoo Molds Inc.

5.2.1 Profile

5.2.2 Tire Mold Product

5.2.3 Operation

5.2.4 Revenue Structure

5.2.5 Gross Margin

5.2.6 Clients

5.2.7 R & D Investment

5.2.8 Major Projects

5.2.9 Forecast and Outlook

5.3 Tianyang Mold Co., Ltd

5.3.1 Profile

5.3.2 Operation

5.4 Shandong Dawang Jintai Group

5.5 Shandong Wantong Mould Co., Ltd

5.5.1 Profile

5.5.2 Operation

5.6 Qingdao Yuantong Machinery Co., Ltd

5.7 Shandong Hongji Mechanical Technology Co., Ltd

5.8 Anhui Mcgill Mould Co., Ltd

5.9 Rongcheng Hongchang Mold Co., Ltd

5.10 Hefei Dadao Mold Limited Liability Company

5.11 Zhejiang Laifu Mould Co., Ltd

Classification of Tire Molds

Classification of Radial Tire Segmented Molds

Upstream and Downstream of Tire Mold Industry

Comparison between Tire Mold Pattern Processing Technologies in China

Business Modes of Major Tire Mold Manufacturers in the World

Policies and Regulations on China Tire Mold Industry, 2005-2012

Development Course of China Tire Mold Industry

Revenue of Automotive Tire Molds in China, 2007-2016E

Production Cost Structure of Tire Molds in China

Capacity of Major Tire Mold Manufacturers in China, 2012

YoY Growth Rate of Revenue of Major Listed Tire Mold Companies, 2009-2012

YoY Growth Rate of Net Income of Major Listed Tire Mold Companies in China, 2009-2012

Tire Output in China, 2006-2010

Output and YoY Growth Rate of Radial Tire Covers in China, 2011-2013

Output Growth Rate of Radial Tire Covers and Automobiles in China, 2006-2013

Revenue Growth Rate of Listed Companies in Tire and Tire Mold Industries, 2006-2012

Distribution of Radial Tire Output in China, 2012

Product Comparison between Major Tire Mold Manufacturers in the World

TOP 10 Tire Mold Manufacturers by Revenue in China, 2012

Major Tire Clients of Himile in Foreign Countries

Major Tire Mold Production Bases of Quality Mold Inc.

Major Tire Pattern Designs of Quality Mold Inc

Main Tire Mold Products of AZ

Major Production Bases of HERBERT in the World

Main Tire Mold Products of HERBERT

Global Business Distribution of SAEHWA IMC

Major Production Bases of SAEHWA IMC in South Korea

Global Production Bases of SAEHWA IMC (Excluding South Korea)

Development Course of SAEHWA IMC

Product Development History of SAEHWA IMC

Main Tire Mold Products of SAEHWA IMC

Turnover of SAEHWA IMC, 2011-2012

Operating Profit and Profit of SAEHWA IMC, 2011-2012

Major Operating Indicators of SAEHWA IMC, 2010-2012

Major Operating Indicators of Shinhan Co., Ltd. Tianjin, 2008-2009

Major Operating Indicators of Saehan Tianjin Mold, 2008-2009

Medium and Long-term Development Planning of SAEHWA IMC

Development Course of Himile

Main Tire Mold Products and Applications of Himile

Tire Mold Capacity, Output and Productivity of Himile, 2008-2010

Sales Prices of Tire Molds of Himile, 2008-2010

Sales Volume and Sales-Output Ratio of Tire Molds of Himile, 2008-2010

Revenue and Net Income of Himile, 2008-2012

Revenue Breakdown of Himile (by Product), 2008-2010

Revenue Breakdown of Himile (by Product), 2011-2012

Revenue Breakdown of Himile (by Region), 2009-2012

Sales Gross Margin of Himile, 2008-2012

Tire Mold Clients of Himile

Himile’s Revenue from Top 5 Clients and % of Total Revenue, 2008-2010

R&D Costs and % of Total Revenue of Himile, 2009-2012

Tire Mold Projects with Raised Funds of Himile

Revenue and Net Income of Himile, 2012-2015E

Main Tire Mold Products of Greatoo Molds

Sales Volume and Unit Price of Radial Tire Molds of Greatoo Molds Inc.

Revenue and Net Income of Greatoo Molds Inc., 2008-2012

Revenue Breakdown of Greatoo Molds Inc. (by Product), 2010-2012

Revenue Breakdown of Greatoo Molds Inc. (by Region), 2008-2012

Gross Margin of Greatoo Molds Inc., 2008-2012

Global Client Distribution of Greatoo Molds Inc.

Major Clients of Greatoo Molds Inc.

R&D Costs and % of Total Revenue of Greatoo Molds Inc., 2008-2011

Projects with Raised Funds of Greatoo Molds Inc.

Revenue and Net Income of Greatoo Molds Inc., 2012-2015E

Revenue of Tianyang Mold, 2009-2012

Major Clients of Tianyang Mold

Tire Mold Products of Shandong Wantong Mold

Revenue of Shandong Wantong Mold, 2009-2012

Smart Car Information Security (Cybersecurity and Data Security) Research Report, 2025

Research on Automotive Information Security: AI Fusion Intelligent Protection and Ecological Collaboration Ensure Cybersecurity and Data Security

At present, what are the security risks faced by inte...

New Energy Vehicle 800-1000V High-Voltage Architecture and Supply Chain Research Report, 2025

Research on 800-1000V Architecture: to be installed in over 7 million vehicles in 2030, marking the arrival of the era of full-domain high voltage and megawatt supercharging.

In 2025, the 800-1000V h...

Foreign Tier 1 ADAS Suppliers Industry Research Report 2025

Research on Overseas Tier 1 ADAS Suppliers: Three Paths for Foreign Enterprises to Transfer to NOA

Foreign Tier 1 ADAS suppliers are obviously lagging behind in the field of NOA.

In 2024, Aptiv (2.6...

VLA Large Model Applications in Automotive and Robotics Research Report, 2025

ResearchInChina releases "VLA Large Model Applications in Automotive and Robotics Research Report, 2025": The report summarizes and analyzes the technical origin, development stages, application cases...

OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025

ResearchInChina releases the "OEMs’ Next-generation In-vehicle Infotainment (IVI) System Trends Report, 2025", which sorts out iterative development context of mainstream automakers in terms of infota...

Autonomous Driving SoC Research Report, 2025

High-level intelligent driving penetration continues to increase, with large-scale upgrading of intelligent driving SoC in 2025

In 2024, the total sales volume of domestic passenger cars in China was...

China Passenger Car HUD Industry Report, 2024

ResearchInChina released the "China Passenger Car HUD Industry Report, 2025", which sorts out the HUD installation situation, the dynamics of upstream, midstream and downstream manufacturers in the HU...

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

ADAS and Autonomous Driving Tier 1 Suppliers Research Report, 2025 – Chinese Companies

Research on Domestic ADAS Tier 1 Suppliers: Seven Development Trends in the Era of Assisted Driving 2.0

In the ...

Automotive ADAS Camera Report, 2025

①In terms of the amount of installed data, installations of side-view cameras maintain a growth rate of over 90%From January to May 2025, ADAS cameras (statistical scope: front-view, side-view, surrou...

Body (Zone) Domain Controller and Chip Industry Research Report,2025

Body (Zone) Domain Research: ZCU Installation Exceeds 2 Million Units, Evolving Towards a "Plug-and-Play" Modular Platform

The body (zone) domain covers BCM (Body Control Module), BDC (Body Dom...

Automotive Cockpit Domain Controller Research Report, 2025

Cockpit domain controller research: three cockpit domain controller architectures for AI Three layout solutions for cockpit domain controllers for deep AI empowerment

As intelligent cockpit tran...

China Passenger Car Electronic Control Suspension Industry Research Report, 2025

Electronic control suspension research: air springs evolve from single chamber to dual chambers, CDC evolves from single valve to dual valves

ResearchInChina released "China Passenger Car Elect...

Automotive XR Industry Report, 2025

Automotive XR industry research: automotive XR application is still in its infancy, and some OEMs have already made forward-looking layout

The Automotive XR Industry Report, 2025, re...

Intelligent Driving Simulation and World Model Research Report, 2025

1. The world model brings innovation to intelligent driving simulation

In the advancement towards L3 and higher-level autonomous driving, the development of end-to-end technology has raised higher re...

Autonomous Driving Map (HD/LD/SD MAP, Online Reconstruction, Real-time Generative Map) Industry Report 2025

Research on Autonomous Driving Maps: Evolve from Recording the Past to Previewing the Future with "Real-time Generative Maps"

"Mapless NOA" has become the mainstream solution for autonomous driving s...

End-to-End Autonomous Driving Research Report, 2025

End-to-End Autonomous Driving Research: E2E Evolution towards the VLA Paradigm via Synergy of Reinforcement Learning and World Models??The essence of end-to-end autonomous driving lies in mimicking dr...

Research Report on OEMs and Tier1s’ Intelligent Cockpit Platforms (Hardware & Software) and Supply Chain Construction Strategies, 2025

Research on intelligent cockpit platforms: in the first year of mass production of L3 AI cockpits, the supply chain accelerates deployment of new products

An intelligent cockpit platform primarily r...

Automotive EMS and ECU Industry Report, 2025

Research on automotive EMS: Analysis on the incremental logic of more than 40 types of automotive ECUs and EMS market segments

In this report, we divide automotive ECUs into five major categories (in...