报告来源:http://www.bimarket.cn/Report/ReportInfo.aspx?Id=19517

Decription

Global H/EV sales to reach 25 million units in 2018

Hybrid and electric vehicle (H/EV) sales will more than double to 25 million units in 2018. Market advances will be led by micro and mild hybrids. Micro hybrids are conventional vehicles equipped with start-stop systems. Mild hybrids also have regenerative braking, and some of these come equipped with a small electric motor that helps start the vehicle but can not propel it without the aid of an internal combustion engine. These systems offer significant fuel savings considering their relatively low cost, and can lower overall vehicle emissions. In 2018, micro and mild hybrids will account for 80 percent of all H/EV demand, followed by full and plug-in hybrids and electric vehicles.

Western Europe to remain largest regional market

Western Europe was the first region to adopt micro/mild hybrid vehicles on a mass scale. As a result, it will remain the largest regional market for micro and mild hybrids and for H/EVs overall, representing 44 percent of total demand in 2018. However, micro/mild hybrid sales are projected to grow faster in other parts of the world, particularly in North America and the Asia/Pacific region. Electric vehicle demand in these regions will exhibit the fastest gains of any type through 2018, albeit from a very small current market base.

Expansion in China, Japan to spur Asia/Pacific growth

The Asia/Pacific region, led by China, will represent the fastest growing market for H/EVs through 2018. Sales gains will be fueled by an increasing number of micro/mild hybrids offered for sale in the country and further narrowing of the price premium over conventional vehicles. In addition, European, Japanese, and US automakers will continue to open and expand existing plants in China and partner with domestic firms to take advantage of government subsidies for vehicles purchased from locally based suppliers. The Asia/Pacific region is also home to Japan, which will remain the world’s largest market for full and plug-in hybrids, representing two-fifths of all demand for those vehicle types in 2018. The US will continue to have the world’s highest electric vehicle sales, accounting for over one-fifth of the global total.

Higher fuel prices, lower cost parts key to H/EV affordability

Increases in overall H/EV demand will be stimulated by high global fuel prices and supported by reductions in component (especially battery) prices as output levels climb and greater economies of scale are achieved. This will help make H/EVs more affordable to the average vehicle purchaser, a particularly major factor in industrializing countries where privately owned vehicles remain a relative luxury. Heightened concerns about air pollution worldwide will also lead to the enactment of additional regulations and subsidy programs supporting sales and use of H/EVs, as these vehicles have the potential to significantly reduce tailpipe emissions.Light vehicles will account for over 99 percent of all H/EV sales in 2018. Nevertheless, demand for fuel-efficient H/EV medium and heavy duty trucks will more than triple as their price premium over conventional models shrinks. The technology required to manufacture H/EVs is more sophisticated than that for conventional motor vehicles. As a result, H/EV production is concentrated among a relatively few large automakers with considerable research and development resources. However, a number of smaller startup companies have entered the electric vehicle industry, with Tesla Motors being the most successful to date. While merger and acquisition activity among vehicle producers is rare, most OEMs have at least one H/EV-related cooperative agreement with another automaker.

Study coverage

This Freedonia industry study, World Hybrid & Electric Vehicles, presents historical data (2003, 2008 and 2013) plus forecasts for 2018 and 2023 for supply and demand, as well as demand by type and segment, in 6 regions and 17 countries. The study also assesses key market environment factors, examines emerging technology, evaluates company market share data and profiles 44 global competitors.

Pricing on the website is provided for single users and 2-5 users licenses only. Please contact us at 400-009-0050 or send an email to report@sinomarketinsight.com to purchase multi-user licenses.

TABLE OF CONTENTS

SECTION PAGE

INTRODUCTION xii

I. EXECUTIVE SUMMARY 1

II. MARKET ENVIRONMENT 4

General 4

World Economic Overview 5

Recent Historical Trends 5

World Economic Outlook 6

World Population Overview 10

Per Capita GDP Trends 12

World Motor Vehicle Overview 14

Motor Vehicle Production 15

Motor Vehicle Demand 18

Motor Vehicles in Use 20

Environmental & Regulatory Factors 22

Emissions Regulations 23

Rebates & Incentives 25

Pricing Trends 27

III. TECHNOLOGY 29

General 29

Hybrid & Electric Powerplants 30

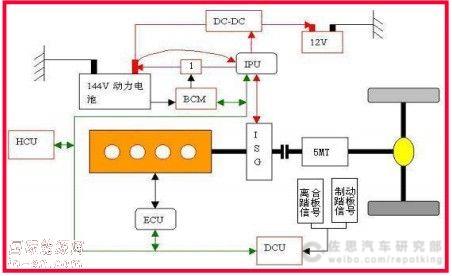

Micro/Mild Hybrid 32

Full Hybrid 33

Plug-In Hybrid 34

Battery Electric 34

Fuel Cell 35

Hybrid & Electric Vehicle Commercialization Issues 36

Safety Concerns 36

Battery Life 36

Electric Vehicle Range 38

Fueling Infrastructure Readiness 38

Energy Storage Technologies 39

Well-to-Wheels Efficiency & Pollution Comparisons 41

Regulatory Compliance 42

Technology Penetration 44

IV. WORLD SUPPLY & DEMAND 45

General 45

Regional Overview 46

Demand 46

Vehicles in Use 49

Production 51

Micro/Mild Hybrid Vehicle Production 54

Full/Plug-In Hybrid & Electric Vehicle Production 55

International Trade 56

Demand by Type 58

Hybrid 61

Micro/Mild Hybrid 62

Full Hybrid 65

Plug-In Hybrid 68

Electric 70

Battery 72

Fuel Cell 73

Demand by Segment 75

Light Vehicles 75

Medium & Heavy Trucks & Buses 78

V. NORTH AMERICA 80

General 80

Hybrid & Electric Vehicle Supply & Demand 81

Hybrid & Electric Vehicle Market Outlook 85

United States 87

Canada 94

Mexico 100

VI. WESTERN EUROPE 107

General 107

Hybrid & Electric Vehicle Supply & Demand 109

Hybrid & Electric Vehicle Market Outlook 112

Germany 115

United Kingdom 121

France 127

Italy 133

Spain 139

Netherlands 145

Belgium 151

Austria 157

Sweden 163

Other Western Europe 169

VII. ASIA/PACIFIC 176

General 176

Hybrid & Electric Vehicle Supply & Demand 178

Hybrid & Electric Vehicle Market Outlook 181

Japan 184

China 191

India 197

South Korea 204

Other Asia/Pacific 210

VIII. OTHER REGIONS 217

Central & South America 217

Eastern Europe 224

Russia 231

Poland 237

Other Eastern Europe 243

Africa/Mideast 249

IX. INDUSTRY STRUCTURE 257

General 257

Industry Composition 258

Market Share 261

Micro/Mild Hybrid Vehicles 262

Full/Plug-In Hybrid Vehicles 263

Electric Vehicles 264

Research & Product Development 266

Manufacturing 267

OEM & Supplier Competitive Strategies 268

Marketing & Distribution 269

Cooperative Agreements 271

Financial Issues & Requirements 280

Mergers, Acquisitions, & Industry Restructuring 281

Company Profiles 283

Alcoa Incorporated 284

Anhui Jianghuai Automobile Company Limited 285

Bayerische Motoren Werke AG 286

Blue Energy, see GS Yuasa and Honda Motor

BMW Brilliance Automotive, see Bayerische Motoren Werke

Bosch (Robert) GmbH 290

BYD Company Limited 295

Chery Automobile Company Limited 298

Chongqing Changan Automobile Company Limited 299

Continental AG 301

Daimler AG 304

Delphi Automotive plc 311

DENSO Corporation 314

Deutsche ACCUmotive, see Daimler

Eaton Corporation plc 316

Exide Technologies 318

Fiat SpA 320

Ford Motor Company 322

Freescale Semiconductor Incorporated 325

Freightliner Custom Chassis, see Daimler

Fuji Electric Company Limited 326

General Motors Company 328

Gillig LLC 331

GS Yuasa Corporation 332

Halla Visteon Climate Control, see Visteon

Hitachi Limited 334

Honda Motor Company Limited 336

Hyundai Motor Company 341

JAC Motors, see Anhui Jianghuai Automobile

JATCO, see Mitsubishi Motors and Nissan Motor

Johnson Controls Incorporated 345

Keihin Corporation 347

Kia Motors, see Hyundai Motor

LG Chem Limited 349

Linamar Corporation 351

Lithium Energy and Power, see Bosch (Robert) and GS Yuasa

Lithium Energy Japan, see GS Yuasa and Mitsubishi Motors

Mazda Motor Corporation 353

Mitsubishi Fuso Truck and Bus, see Daimler

Mitsubishi Motors Corporation 355

New Flyer Industries Incorporated 359

Nissan Motor Company Limited 361

NMKV, see Mitsubishi Motors and Nissan Motor

NuCellSys, see Daimler

Panasonic Corporation 368

Peugeot SA 370

Renault SA 373

Saft Groupe SA 378

SAIC Motor Corporation Limited 380

Samsung SDI Company Limited 381

SB LiMotive, see Samsung SDI

Shenzhen BYD Daimler New Technology, see BYD and Daimler

Suzuki Motor Corporation 383

TE Connectivity Limited 385

Tesla Motors Incorporated 386

Toshiba Corporation 389

Toyota Motor Corporation 391

Valeo SA 398

Visteon Corporation 402

Volkswagen AG 404

Volvo Car Group 410

ZF Friedrichshafen AG 412

Zytek Group Limited 415

Other Companies Mentioned in the Study 417

LIST OF TABLES

TABLE NUMBER PAGE

SECTION I -- EXECUTIVE SUMMARY

Summary Table 3

SECTION II -- MARKET ENVIRONMENT

1 World Gross Domestic Product by Region 9

2 World Population by Region 12

3 World Per Capita Gross Domestic Product by Region 14

4 World Motor Vehicle Production by Type & Region 18

5 World Motor Vehicle Demand by Type & Region 20

6 World Motor Vehicles in Use by Type & Region 22

SECTION III -- TECHNOLOGY

1 Comparison of Hybrid & Electric Powertrain Types 31

SECTION IV -- WORLD SUPPLY & DEMAND

1 World Hybrid & Electric Vehicle Demand by Region 48

2 World Hybrid & Electric Vehicles in Use by Region 50

3 World Hybrid & Electric Vehicle Production by Region 53

4 World Micro/Mild Hybrid Vehicle Production by Region 55

5 World Full/Plug-In Hybrid & Electric Vehicle

Production by Region 56

6 World Hybrid & Electric Vehicle Net Exports by Region 58

7 World Hybrid & Electric Vehicle Demand by Type 60

8 World Hybrid Vehicle Demand by Type & Region 62

9 World Micro/Mild Hybrid Vehicle Demand by Region 64

10 World Full Hybrid Vehicle Demand by Region 67

11 World Plug-In Hybrid Vehicle Demand by Region 69

12 World Electric Vehicle Demand by Type & Region 71

13 World Hybrid & Electric Vehicle Demand by Segment 75

14 World Hybrid & Electric Light Vehicle

Demand by Type & Region 77

15 World Hybrid & Electric Medium & Heavy Duty

Truck & Bus Demand by Type & Region 79

SECTION V -- NORTH AMERICA

1 North America: Hybrid & Electric Vehicle Supply & Demand 84

2 North America: Hybrid & Electric Vehicle Demand

by Type & Segment 86

3 United States: Hybrid & Electric Vehicle Supply & Demand 91

4 United States: Hybrid & Electric Vehicle Demand

by Type & Segment 93

5 Canada: Hybrid & Electric Vehicle Supply & Demand 98

6 Canada: Hybrid & Electric Vehicle Demand

by Type & Segment 100

7 Mexico: Hybrid & Electric Vehicle Supply & Demand 104

8 Mexico: Hybrid & Electric Vehicle Demand

by Type & Segment 106

SECTION VI -- WESTERN EUROPE

1 Western Europe: Hybrid & Electric Vehicle

Supply & Demand 111

2 Western Europe: Hybrid & Electric Vehicle Demand

by Type & Segment 114

3 Germany: Hybrid & Electric Vehicle Supply & Demand 119

4 Germany: Hybrid & Electric Vehicle Demand

by Type & Segment 121

5 United Kingdom: Hybrid & Electric Vehicle

Supply & Demand 125

6 United Kingdom: Hybrid & Electric Vehicle Demand

by Type & Segment 127

7 France: Hybrid & Electric Vehicle Supply & Demand 131

8 France: Hybrid & Electric Vehicle Demand

by Type & Segment 133

9 Italy: Hybrid & Electric Vehicle Supply & Demand 137

10 Italy: Hybrid & Electric Vehicle Demand

by Type & Segment 139

11 Spain: Hybrid & Electric Vehicle Supply & Demand 143

12 Spain: Hybrid & Electric Vehicle Demand

by Type & Segment 145

13 Netherlands: Hybrid & Electric Vehicle Supply & Demand 149

14 Netherlands: Hybrid & Electric Vehicle Demand

by Type & Segment 151

15 Belgium: Hybrid & Electric Vehicle Supply & Demand 155

16 Belgium: Hybrid & Electric Vehicle Demand

by Type & Segment 157

17 Austria: Hybrid & Electric Vehicle Supply & Demand 161

18 Austria: Hybrid & Electric Vehicle Demand

by Type & Segment 163

19 Sweden: Hybrid & Electric Vehicle Supply & Demand 167

20 Sweden: Hybrid & Electric Vehicle Demand

by Type & Segment 169

21 Other Western Europe: Hybrid & Electric Vehicle

Supply & Demand 173

22 Other Western Europe: Hybrid & Electric Vehicle Demand

by Type & Segment 175

SECTION VII -- ASIA/PACIFIC

1 Asia/Pacific: Hybrid & Electric Vehicle Supply & Demand 180

2 Asia/Pacific: Hybrid & Electric Vehicle Demand

by Type & Segment 183

3 Japan: Hybrid & Electric Vehicle Supply & Demand 188

4 Japan: Hybrid & Electric Vehicle Demand

by Type & Segment 190

5 China: Hybrid & Electric Vehicle Supply & Demand 195

6 China: Hybrid & Electric Vehicle Demand

by Type & Segment 197

7 India: Hybrid & Electric Vehicle Supply & Demand 202

8 India: Hybrid & Electric Vehicle Demand

by Type & Segment 204

9 South Korea: Hybrid & Electric Vehicle Supply & Demand 208

10 South Korea: Hybrid & Electric Vehicle Demand

by Type & Segment 210

11 Other Asia/Pacific: Hybrid & Electric Vehicle

Supply & Demand 214

12 Other Asia/Pacific: Hybrid & Electric Vehicle Demand

by Type & Segment 216

SECTION VIII -- OTHER REGIONS

1 Central & South America: Hybrid & Electric Vehicle

Supply & Demand 221

2 Central & South America: Hybrid & Electric Vehicle

Demand by Type & Segment 223

3 Eastern Europe: Hybrid & Electric Vehicle

Supply & Demand 227

4 Eastern Europe: Hybrid & Electric Vehicle Demand

by Type & Segment 230

5 Russia: Hybrid & Electric Vehicle Supply & Demand 235

6 Russia: Hybrid & Electric Vehicle Demand

by Type & Segment 237

7 Poland: Hybrid & Electric Vehicle Supply & Demand 241

8 Poland: Hybrid & Electric Vehicle Demand

by Type & Segment 243

9 Other Eastern Europe: Hybrid & Electric Vehicle

Supply & Demand 247

10 Other Eastern Europe: Hybrid & Electric Vehicle Demand

by Type & Segment 249

11 Africa/Mideast: Hybrid & Electric Vehicle

Supply & Demand 254

12 Africa/Mideast: Hybrid & Electric Vehicle Demand

by Type & Segment 256

SECTION IX -- INDUSTRY STRUCTURE

1 World Hybrid & Electric Vehicle Sales by Company, 2013 260

2 Selected Cooperative Agreements 273

3 Selected Acquisitions & Divestitures 282

LIST OF CHARTS

CHART NUMBER PAGE

SECTION IV -- WORLD SUPPLY & DEMAND

1 World Hybrid & Electric Vehicle Demand by Region, 2013 49

2 World Hybrid & Electric Vehicles in Use by Region, 2013 51

3 World Hybrid & Electric Vehicle Production by Region, 2013 54

4 World Hybrid & Electric Vehicle Demand by Type, 2013 60

5 World Micro/Mild Hybrid Vehicle Demand by Region, 2013 65

6 World Full Hybrid Vehicle Demand by Region, 2013 68

7 World Plug-In Hybrid Vehicle Demand by Region, 2013 70

8 World Electric Vehicle Demand by Region, 2013 72

SECTION V -- NORTH AMERICA

1 North America: Hybrid & Electric Vehicle Demand

by Country, 2013 85

SECTION VI -- WESTERN EUROPE

1 Western Europe: Hybrid & Electric Vehicle Demand

by Country, 2013 112

SECTION VII -- ASIA/PACIFIC

1 Asia/Pacific: Hybrid & Electric Vehicle Demand

by Country, 2013 181

SECTION VIII -- OTHER REGIONS

1 Eastern Europe: Hybrid & Electric Vehicle Demand

by Country, 2013 228

SECTION IX -- INDUSTRY STRUCTURE

1 World Hybrid & Electric Vehicle Market Share, 2013 262

2 World Micro/Mild Hybrid Vehicle Market Share, 2013 263

3 World Full/Plug-In Hybrid Vehicle Market Share, 2013 264

4 World Electric Vehicle Market Share, 2013 265

报告来源:http://www.bimarket.cn/Report/ReportInfo.aspx?Id=19517